A data-driven momentum portfolio engineered to capture market leaders.

A systematic, rules-based stock basket that identifies strong price trends and rotates into emerging market leaders. Built for investors who are comfortable with volatility and want disciplined alpha generation.

Who This Is For

Markets reward process over prediction. Our algorithms follow data & not headlines, delivering consistent, emotion-free execution. Back-tested across cycles · Built on robust risk management · Aligned with market leadership.

Core Investment Thesis

Benchmark & Universe

Markets reward process over prediction. Our algorithms follow data & not headlines, delivering consistent, emotion-free execution. Back-tested across cycles · Built on robust risk management · Aligned with market leadership.

Benchmark

Nifty 500

Coverage

Large-cap, mid-cap, and small-cap momentum opportunities.

It provides enough diversification to identify new leaders early, without limiting exposure to only established names.

Why rule based investing works

Markets reward process over prediction. Our algorithms follow data & not headlines, delivering consistent, emotion-free execution. Back-tested across cycles · Built on robust risk management · Aligned with market leadership.

KeyPoint 1

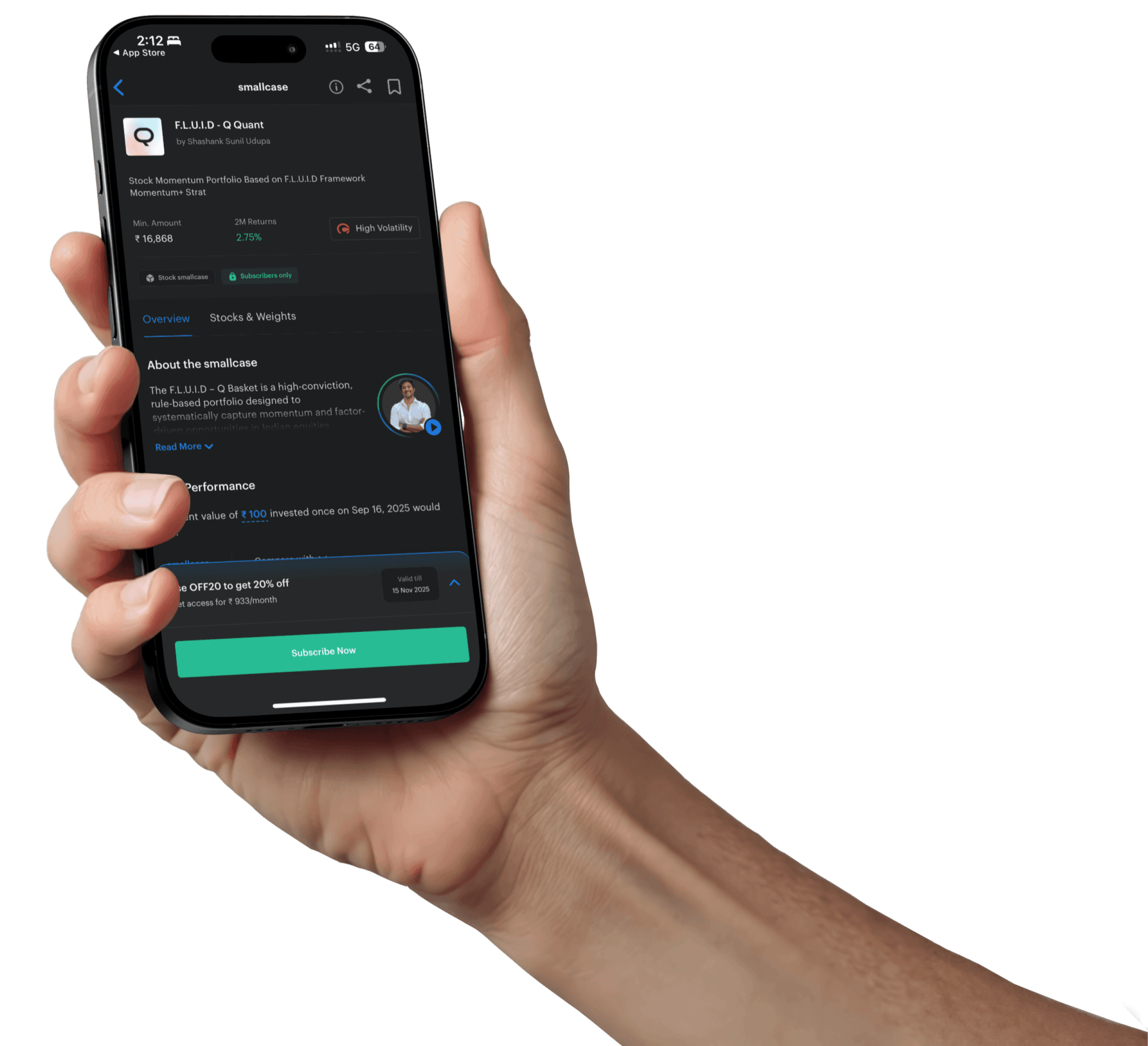

Stock Momentum Portfolio Based on

F.L.U.I.D Framework Momentum+ Strat

KeyPoint 1

Stock Momentum Portfolio Based on

F.L.U.I.D Framework Momentum+ Strat

KeyPoint 1

Stock Momentum Portfolio Based on

F.L.U.I.D Framework Momentum+ Strat

F.L.U.I.D Framework

Markets reward process over prediction. Our algorithms follow data & not headlines, delivering consistent, emotion-free execution. Back-tested across cycles · Built on robust risk management · Aligned with market leadership.

Rebalancing Frequency: Monthly

Stay synced with the market’s evolving trend structure.

Replace weakening momentum names

Stock Momentum Portfolio Based on

F.L.U.I.D Framework Momentum+ Strat

Add new breakout leaders

Stock Momentum Portfolio Based on

F.L.U.I.D Framework Momentum+ Strat

Adjust weights based on strength

Stock Momentum Portfolio Based on

F.L.U.I.D Framework Momentum+ Strat

Risk Managment

Markets reward process over prediction. Our algorithms follow data & not headlines, delivering consistent, emotion-free execution. Back-tested across cycles · Built on robust risk management · Aligned with market leadership.

Ride Strength

Stop-loss thresholds on

momentum breakdown

Accept Volatility Thoughtfully

Regular monitoring of

volatility signals

Stay Adaptive

Only liquid names to avoid

execution issues

Accept Volatility Thoughtfully

Acceptance of drawdowns as

part of the strategy

Accept Volatility Thoughtfully

Concentrated but not

crowded exposure

Portfolio Structure

Markets reward process over prediction. Our algorithms follow data & not headlines, delivering consistent, emotion-free execution. Back-tested across cycles · Built on robust risk management · Aligned with market leadership.

Past performance is not indicative of future returns.

Ready to Invest Smarter ?

A proprietary framework that blends quantitative precision with fundamental conviction — removing emotion from investing and letting rules create results.